/teamviewer-38ff4d2cbfbd4d7d977256f9d88e297b.png)

Its major problem areas include its inability to share big files and limited features in the free version.

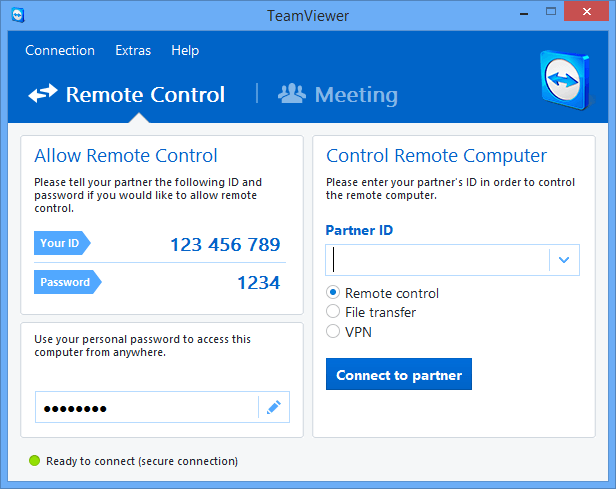

TEAM VIEWER SOFTWARE

However, many users do not prefer TeamViewer as a remote desktop software solution, as it falls short when the work task is in context with the proxy servers. Looking for Remote Desktop Software? Check out SoftwareSuggest’s list of the best Remote Desktop Software in 2020.

At wallstreet:online, we already see a discrepancy in the valuation compared to the competition. TeamViewer and Commerzbank are facing decisive milestones. The so-far positive stock market year is ending, and the indices could even aim for new highs in the last trading weeks. However, the stock should be on every watch list due to the positive operating development. "From this point of view, I still feel very comfortable with the forecast of closing the year with a positive net result," Orlopp emphasized.Īfter another bounce off the resistance at EUR 6.60, a further setback to the support area at EUR 6.20 would be likely. After booking a total of EUR 257 million in loan losses in the first three quarters, a worst-case scenario would have to occur in the fourth quarter. The Frankfurt-based bank has issued a risk result of less than EUR 700 million for 2021, CFO Bettina Orlopp told Börsen-Zeitung. In addition, the management recently announced that it would exceed the magic mark of EUR 10 billion in assets under management as early as the beginning of the next calendar year.ĭespite the uncertainties caused by the Corona pandemic, Commerzbank has reiterated its target for the year. In addition to the further dovetailing of the Social and Transaction segments, the launch of the Smartbroker app is scheduled for the coming half-year, which could well trigger further customer growth. In terms of deposits per customer custody account, it also outperforms the significantly more highly valued competition by a factor of six in some cases.

In terms of assets under management, Smartbroker is already the leader with EUR 6.8 billion. With a market capitalization of currently EUR 350.36 million, the Company lags well behind local competitors such as Trade Republic and Scalable Capital. With the connected community and approximately 830,000 users, a great unique selling point, the Berliners have the reins in their hands to link information and transactions. On the other hand, the selection of around 40 trading venues, including all stock exchanges in Germany, resembles that of a full-service broker. For one thing, the fees come close to those of a neobroker. The Berliners intend to use this to further boost the growth of their neobroker Smartbroker, whose operating company wallstreet:online Capital already holds a more than 95% stake. The largest independent financial portal operator in the German-speaking world by far has subscribed to new shares for a total amount of around EUR 8 million as part of a capital increase by its subsidiary, wallstreet:online Capital AG. The current situation at wallstreet:online AG is quite different. The publication of encouraging figures for the fourth quarter should help the Company. A further slide, even into the single-digit range, is not impossible from a chart perspective. The stock is currently trading at EUR 11.25, just above its low for the year. The US bank JPMorgan recently left its rating for TeamViewer at "Overweight" with a price target of EUR 21. These are among TeamViewer's most important growth regions.

With Hera Kitwan Siu as a member of the Supervisory Board and Sojung Lee, who recently joined the Senior Leadership Team as the new President for the APAC region, the Company has gained two proven experts for the Asian markets. In order to strengthen the Asian business, the staff was qualitatively increased. At the Company's capital market day, a new action plan was presented, the head of marketing and the CFO had to vacate their chairs. Despite the enterprise business doing well, a further decline in billings could threaten profitability. Achieving even the softened revenue target of around EUR 500 million and an operating margin between a still high 44-46% seems ambitious. The Goeppingen-based Company has already revised its forecasts downwards twice this year. Growth is lagging behind forecasts, business in Asia is weakening, and margins are falling from quarter to quarter due to high sponsorship costs. As an analysis explains, TeamViewer AG's development is in dire straits.

0 kommentar(er)

0 kommentar(er)